Measuring Societies

Quantification of human group-behavior and social dynamics poses a unique challenge. Usually the bottleneck in scientific approaches to the matter is the availability and the quality of data. Modern massive multiplayer online games (MMOG) provide a fascinating way of simultaneously observing thousands of individuals engaged in social activities and relations as well as pursuing basic economic activities to sustain a ‘living’ in a virtual game-universe.

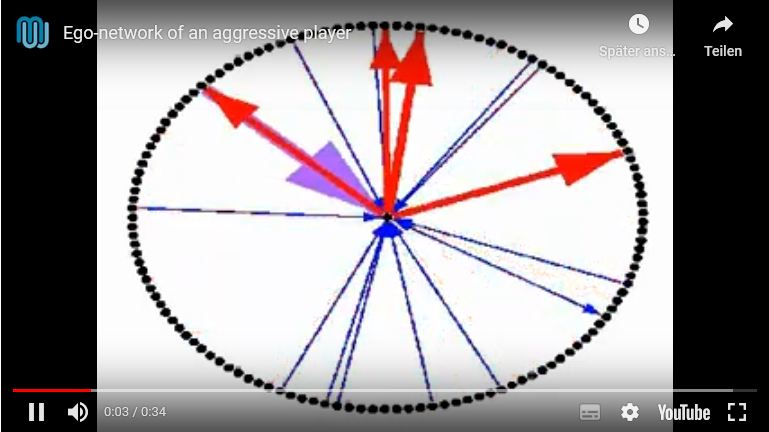

We have compiled high-frequency log files of such a massive multiplayer online game played by over 300,000 users allowing us to assess socioeconomic dynamics over the past four years. We are able to relate social and economic behavior of the players to a series of stylized facts known to exist in the real world. In particular, we analyze the evolution of underlying growing social networks such as constituted by friends and enemies, communication or trade networks, or networks of attacks, and measure their characteristic properties. We observe striking differences in topological structure between positive tie (e.g., friend) and negative tie (e.g., enemy) networks. We compare our findings with literature on real world data. With this setup we try to establish a ‘laboratory’ for economical behavior.

Video – Ego-network of an aggressive player

After activation, data will be sent to YouTube. Further information here: Data protection

Video – Time evolution of a friend/enemy network

After activation, data will be sent to YouTube. Further information here: Data protection

Financial Markets

We design Agent-Based Models to shed light on emergent phenomena in financial markets. We proposed a model that allows to understand the origin of financial crashes.

We study an ecology of financial agents who all perform their specific roles in the financial system. By interacting with each other they create a complex system which leads to a series of counter-intuitive properties. For example, we see that certain forms of regulation of financial markets can have destabilizing effects on the system. In particular, we study the role played by leverage, the widely used habit of making speculative investments with borrowed money, which is strongly associated with the financial crisis of 2008–2010.

Efficiency and Bureaucracy

We employ tools from network analysis to analyze flows of information within institutions, firms or bureaucratic bodies. With special choices of network projections we can illustrate and visualize efficiency within subunits of firms. With agent based models we explore the dangers of ‘bureaucratic infarction’, i.e. the risk that bureaucratic bodies produce more internal work than the entire workforce of a company or institution can handle and thereby destroying it.